Gaining a clear picture of a company’s financial position There are many advantages of double-entry accounting.

This method provides a more complete picture of a business’s finances, and is typically used by larger businesses. This method is simpler and can be used for smaller businesses.ĭouble-entry accounting is a system where each transaction is recorded in at least two accounts. Single-entry accounting is a system where transactions are only recorded once, either as a debit or credit in a single account. Income accounts represent the revenue of a business, such as sales and interest incomeĮxpense accounts represent the costs of a business, such as rent and utilities.Įquity accounts represent the funds invested in a business and the amount of profit left after operation costs, also known as, retained income. Liability accounts represent the debts of a business, such as loans and accounts payable.

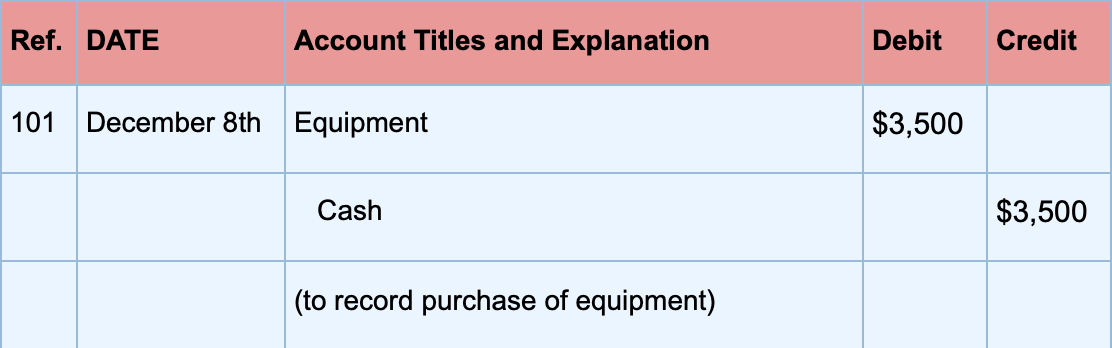

The five main types of accounts used in double-entry bookkeeping are:Īsset accounts represent the resources of a business, such as cash, inventory, and equipment. This accounting system also allows you to track business finances more effectively, and make better decisions about where to allocate your resources. A double-entry system provides a check and balance for each transaction, which helps ensure accuracy and prevent fraud. What is double-entry accounting?ĭouble-entry accounting is a system of bookkeeping where every financial transaction is recorded in at least two accounts. This guide will tell you more about double-entry accounting, how it works, and whether a career in accounting is right for you. This bookkeeping method also complies with the US generally accepted accounting principles (GAAP), the official practice and rules for double-entry accounting. Many companies, regardless of their size or industry, use double-entry accounting for their bookkeeping needs because it provides a more accurate depiction of their financial health.

0 kommentar(er)

0 kommentar(er)