You may have heard that you need a good credit score to buy a car, but that’s simply not true. What is a Good Credit Score Range to Buy a Car? Banks take heavy consideration into the vehicle you are attempting to finance when determining the rate to give your loan. The newer and lower mileage the vehicle has, the better rate you will get. You must also bear in mind that the type of vehicle you are purchasing will have a huge impact on your interest rate as well. If you’re not in a big hurry to buy a car, you can also wait for a couple of months to see how the market changes. It’s not a bad idea to shop around to see where you can get the lowest interest rate. Interest rates are determined by the conditions of the market as well as what, and where you borrow. Keep in mind that interest rates can fluctuate no matter what your credit score is.

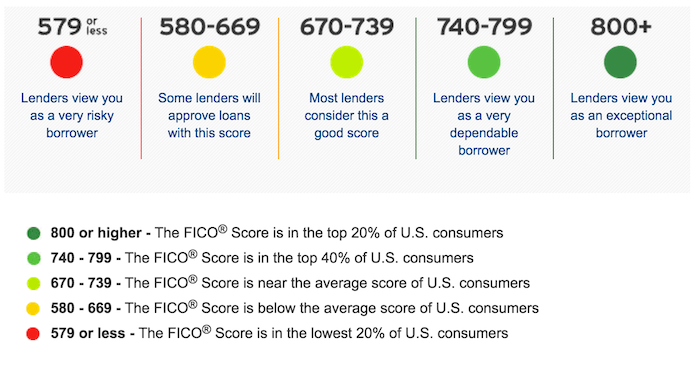

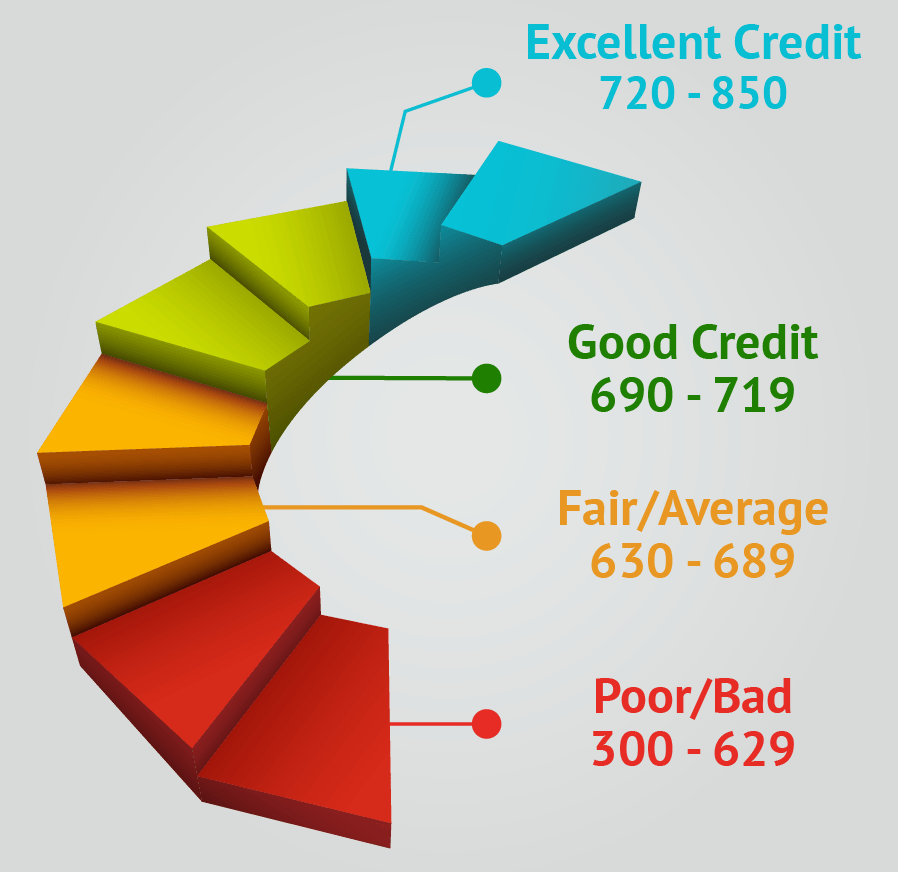

If you’re willing to pay a bit extra throughout the life of your loan, or if you genuinely need a vehicle now, it’s still worth it to look for a loan. Again, you can still get a loan you just might wind up paying a little bit more in the long run. But did you know it can also impact the amount that you pay for your vehicle? Those with lower credit scores will likely be offered higher interest rates than those with higher credit scores. So, we know that your credit score impacts whether or not you get approved for a loan. You might have had issues with payments in the past, but the fact that you can hold a job for several years goes a long way with many lenders. If you’ve been at the same job or address for several years it will greatly increase your odds for approval. Lenders will look at this ratio to see if you can truly afford to add another payment to your monthly load. As the name suggests, this data point compares your income to the amount of debt you currently have. The other factors to keep in mind are your debt-to-income ratio. Your credit score can also impact the interest rate you receive, but we’ll talk more about that in a moment. Of course, those with higher scores have higher approval odds, but again, this is not the only factor.

Your credit score is usually used as a starting point for lenders. If your credit score isn’t very strong, lenders will look for other areas of stability to get you approved. They’ll often look at your credit score in combination with your income, your debt-to-income ratio, time on the job, and length of residency at one address. In your application for a car loan, lenders don’t only want to know your credit score. What Lenders Look Forīefore you can talk about the credit score you need to buy a car, it’s important to know what lenders are looking for. Even with a lower credit score, you can still get a good deal on a car by doing a bit of research beforehand. But that doesn’t mean that you’re out of the running for a vehicle. If you know your credit score is less-than-stellar, the already stressful process of car buying can be taken to a whole new level. When you’re looking into buying a new car, your credit can be a cause for concern.

0 kommentar(er)

0 kommentar(er)